Your car’s market value may be higher than the residual, meaning you’re getting a great deal if you buy out the lease. If you’ve done your homework and researched your car’s equity, you’ll have an advantage. In the event that you plan to buy out your lease, the residual value is what you’ll pay for the car. In an open-end lease, however, there’s a decent chance that you’ll have to pay the difference between the residual and market values, so be wary of this when you enter into a lease agreement.

If you’re simply returning the car, then you’ll want to know whether you have a closed-end lease and open-end lease.Ĭlosed-end leases are basically a sealed deal the car’s residual value is firm and if the car winds up worth less at the end of your lease than the residual value, it doesn’t matter. It can also affect the end of your lease in different ways, however, depending on the type of lease you have and what you plan to do with the car. How your residual value will affect your leaseĪt the end of the day, your residual value is what determines your monthly payments over the lease’s term, so its effects are felt throughout the lease. See how much you can save buying nearly new vs. When it comes to buying a used car, you want to find the perfect intersection of savings and reliability. If the car’s been undervalued and its residual value is lower than the current market value, you can reap the difference in profit.īut regardless of what you do, having this information ready gives you the upper hand.

#Residual value of a car how to#

This information will allow you to make an informed decision about how to end your lease. Our CoPilot Compare tool will show you side-by-side comparisons of a vehicle’s original MSRP with its current market value. A multitude of things, such as an increase in market demand or a minuscule amount of wear-and-tear can happen over the course of your lease that can affect your car’s value in unexpected ways.Īt the end of your lease, you should do your own research to find the current market value of your car, which you can do with CoPilot. While lessors have their own logic behind setting a car’s residual value, it doesn’t mean they’re always right. For example, if you’re leasing a Subaru Forester that has an MSRP of $40,000, and your residual value is set at 50%, then the residual value at the end of the lease will be $20,000. These values are typically expressed as a simple percentage of the vehicle’s Manufacturer Suggested Retail Price.

Understanding the set residual value in your lease contract is crucial, but thankfully it’s also easy. The idea, though, is that they’ve done enough research to determine how much your car will depreciate over the term of the lease and use this to estimate the value of the car at the lease’s end. Leasing companies have the power in calculating and deciding the residual value of your car, and it’s not always clear exactly how they arrive at their numbers. How to calculate your car’s residual value Thinking of selling your leased car? Learn about the best way to put money in your pocket with your lease by using CoPilot Compare. However, if you are simply returning your lease, the residual value’s role may get a bit more complex.

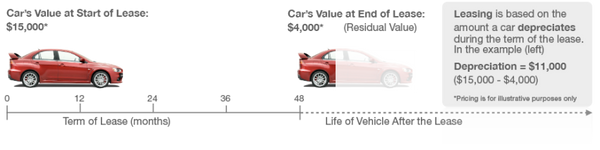

If you opt to buy your leased vehicle at the end of the lease, you’ll be paying the residual value, so it’s important to be aware of this number. On the other hand, if your lessor calculates a low residual value at the end of your lease, payments may be a little higher. Generally, the less depreciation that the lessor expects for your vehicle, the lower your monthly payments will be. One of the most important aspects of the residual value is the fact that it directly affects your monthly payments for the lease. However, residual value calculations are typically affected by things like fluctuations in gas prices, market changes, and technological innovations. Your leasing company will determine this at the beginning of your lease, but how, exactly, this is determined will depend on many factors and can vary from dealership to dealership. The residual value of your lease is essentially an estimation of how much your leased vehicle will be worth after it depreciates over the period of your lease. In this article, we’ll explain the meaning and importance of your lease’s residual value, as well as how to calculate it and how to use this information to your advantage. There are several factors at play when it comes to buying out or selling your lease that you need to be aware of, and CoPilot is here to help teach you everything you need to know.

#Residual value of a car full#

Trying to sell your lease after you’ve decided to move on from your car? Or are you wanting to buy out your car from the lease to gain full ownership? If so, you’re in the right place!

0 kommentar(er)

0 kommentar(er)